Table of Contents

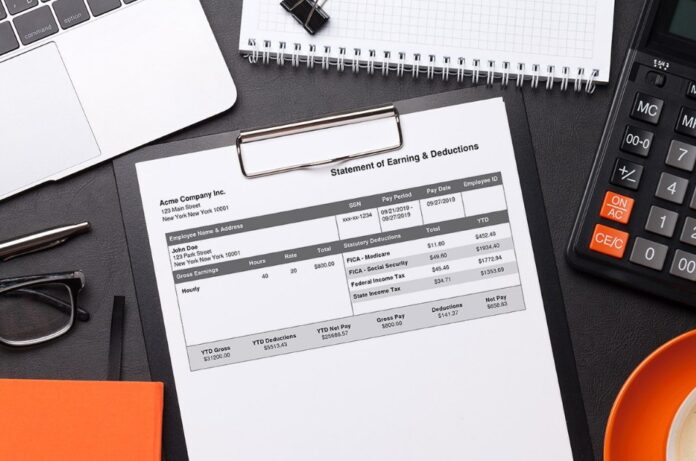

A pay stub is a crucial document that must be provided to the employees to have a better understanding and detailed information about their net salary. This document is given to them at the time of providing them with a monthly salary for services rendered.

It contains a good deal of information regarding payment details including employee taxes and deductions. It is important for employers to properly prepare check stubs and follow rules and laws associated with them. In this article, we will get insights into the rules to follow before handing over pay stubs to the employees.

Laws and rules to follow before providing pay stubs to your employees

1. Federal laws and rules

The federal government has a number of laws and regulations in place to ensure that employees get fair pay. As per the Federal laws and regulations, employers are responsible to ensure that employees get their check stubs on time and in the right format.

The Fair Labor Standards Act (FLSA) requires employers to provide employees with check stubs that include specific information about the hours worked and wages earned during the pay period. It also ensures that they get a check stub when they earn over $200 in any given month.

In addition to this, there are a few general rules that must be followed when preparing pay stubs for the employees.

- A pay stub must include detailed information on total hours worked, total wages paid, deductions from wages, net wages or check amount, gross income, federal, state and local taxes withheld, and any other information required by state laws.

- The employer must ensure that proper tax forms are included on each check stub. Any deductions made from an employee’s pay stub, including taxes and insurance premiums must be documented properly.

- The check stub must have a detailed listing of all deductions so employees can verify what they are paying for.

- The employer must issue payroll checks within seven days after the end of each payroll period. You should e-file your employee’s W2s and 1099s with the IRS. It will allow them to pay their taxes in time, and they could avoid getting into some trouble by knowing detailed information about their net salary.

Are you looking forward to generating legal and accurate pay stubs? Get the highest quality paystubs, W2s, 1099s, and invoices for yourself as well as for your employees online in accordance with all the rules and laws at your mailbox without any hassle.

2. State laws and rules

Besides Federal laws and rules, employers have to follow state laws and rules as well before handing over check stubs to their employees. Although, you should know that each state has its own requirements for how much information you can include on a check stub.

In most states, the state laws are extensions to federal laws i.e. along with the information listed in federal laws, the employer might have to include some extra information which usually varies by state.

- Employers must also keep accurate records of the time they allow employees to take off, such as vacation or sick days. It must also include their name and address, along with the amount of money paid to them.

- Employers must also provide employees with a statement of earnings and deductions quarterly. In some states, employers are required to provide a detailed written statement of a paycheck at least twice per month.

- If an employee is paid hourly, include hours worked and overtime hours worked on the stub. If they are paid by commission, include total commissions earned and gross commissions percentage.

- Employers must ensure each employee has a copy of the check stub from the previous pay period. This will allow them to calculate how much they are owed in taxes.

- They must also ensure that there is a designated person in charge of issuing paychecks and keeping track of who has received them. This person should be responsible for making sure that no one is left out or forgotten about when it comes time to issue check stubs.

- As per state laws and regulations, a check stub must include additional details such as employee name, pay period and date, hours worked, gross salary, deductions, taxes, employer contributions, direct deposit information, and net salary.

What is the purpose of pay stubs?

The purpose of a pay stub is to keep track of what an employee has earned over time so that they can see if they have paid the correct amount in taxes or if there are any errors made in calculating their gross earnings before taxes were deducted.

Employers use check stubs to keep track of how much they owe their employees on any given pay period. It is also an important part of the company’s record-keeping process. If your company is audited by the IRS or other third parties, having clear and accurate records can help you avoid fines or penalties.

On the contrary, employees can keep track of their earnings and ensure that they have paid all taxes. It provides detailed statistics of the amount of money paid to them after charging taxes and deductions. The advantages of having access to detailed information on a check stub are significant.

This piece of document is significant when negotiating for higher wages with their employer. They can also use this information when calculating any income tax that needs to be paid at the end of each year.

The Bottom-line

Pay stubs are one of the most significant accounting documents that you will have to deal with as an employer. Furthermore, you must follow the laws and rules associated with it while preparing these documents. It is often used as proof of income when applying for loans or other financial services by the employees.

This crucial piece of document is also used while paying yearly taxes. These were some rules and regulations that employers must follow when giving employees their check stubs. All the information must be provided properly so they can get a detailed analysis of their net salary.